Insight Report: Infrastructure pipeline key to mitigating Brexit effects

01 May 2018

Construction

Environment

Environment Analyst invited senior executives from five leading environmental consulting providers to discuss the current and future market drivers and growth prospects, amidst the challenges facing their businesses and the wider industry on account of Brexit. Delta-Simons Managing Director, Alex Ferguson takes part.

Infrastructure fuels good times in EC sector

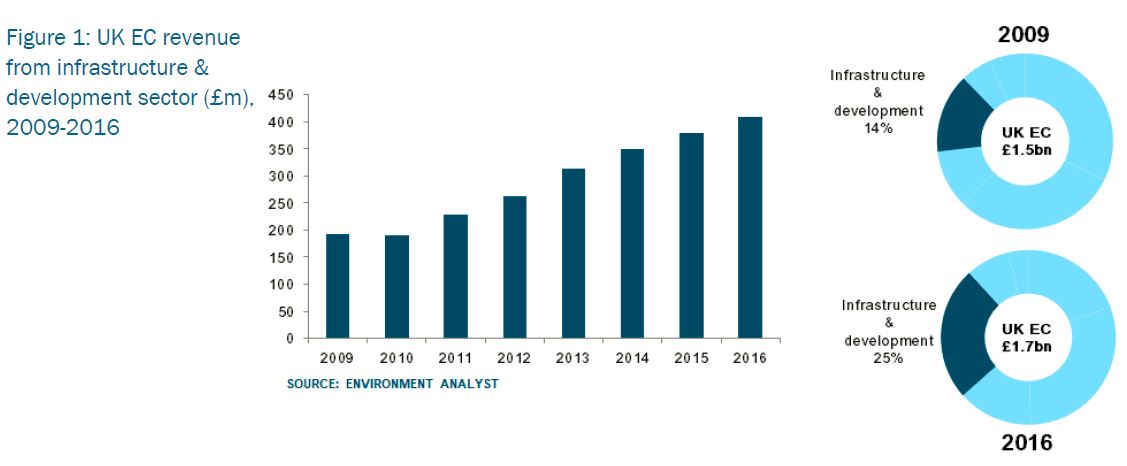

It would be no exaggeration to say the last few years have been a very good time to be an environmental consultant in the UK. Environment Analyst’s latest market assessment figures show that in 2015 and 2016 the total market for EC services grew by 10% and 6.3% respectively - far in excess of the UK’s economic growth of 2.2% and 1.8% for those years.

When the figures for 2017 are finalised, EA expects the market to outperform the economy once again, albeit at a slightly reduced growth rate of 4-5% due to the fallout from Brexit.

The net impact is that in the last three years around £310m will have been added to the UK environmental consultancy market. The majority of this has not come from corporate moves to improve supply chain sustainability or big energy efficiency drives for commercial properties, and certainly not because of any radical changes to environmental regulation. But rather most has come from the UK’s vast queue of planning and consenting work for large-scale development, regeneration and infrastructure projects. And there seems little sign of that slowing.

Director of environmental consulting at Royal HaskoningDHV Matthew Hunt says of the pipeline contraction: “Yes the total value fell, but £460bn is still a very big number. It is also important to remember it’s a pipeline – projects will be added, and as they are completed they will be removed.”

For example, the latest pipeline estimates don’t include any allowance for the water industry’s AMP7 capital investment period starting in 2020 because the utilities have yet to finalise their investment strategies responding to the 2019 price review. This alone could add in excess of £40bn to the pipeline.

Arup’s environmental consultancy practice achieved double-digit revenue growth in 2016/17 mainly because of the large-scale infrastructure projects the firm is supporting (EA 20-Feb-18). And this year sees the c180-strong team heavily involved in the environmental impact assessment (EIA) for HS2 Phase 2b, while it is also expecting petitioning work relating to HS2 Phase 2a when the bill goes through its second reading in the House of Commons. As a result Arup’s director of global environmental consultancy Michael Bull feels confident enough to say he is “very optimistic for 2018”.

“Airports are also becoming big clients of ours with many looking to increase their passenger capacity without needing an additional runway with obvious connotations for noise and air quality,” says Bull. “And we are seeing more activity from nuclear projects and gas clients looking to build CCGT plants. Roads too are a very buoyant area.”

Managing principal of Ramboll’s UK environment & health division, Matt Davies, agrees that infrastructure opportunities will continue to offer rich pickings for the EC sector, stating: “There has been an acceleration in activity in the areas of road, rail, ports & harbours, electricity transmission, communications and airports. Ramboll environment & health has certainly seen that and EIA is as busy as ever.”

In 2017 many large infrastructure programmes within the NIP began construction; and by 2021 around £300bn of the current pipeline will have been spent on 360 projects

But it isn’t only in the planning phases where environmental consultancies are winning work. Ramboll, like many other firms, is also seeing a significant uptick in demand for support during the construction phase of projects which can be just as time consuming, and therefore income-generating, for consultants. In 2017 many large infrastructure programmes within the NIP began construction; and by 2021 around £300bn of the current pipeline will have been spent on 360 projects. To put this in perspective – only 20 projects were signed off in 2016. Many build-out periods can last 3-4 years with ecology monitoring, noise assessments and construction waste auditing commonly featuring on the list of specialist requirements.

Large-scale projects: risks vs. rewards

But winning work on the big-ticket projects has its cons as well as its pros. On one hand, it's hard to turn down a multi-million contract that could keep the majority of your team busy for up to five years or more, but on the other it may expose your business significant resourcing issues when the contract ends, with replacement sources of work needed to avoid staff layoffs.

In addition questions surrounding the on-going and future financing, management and procurement of long-term public sector programmes thrown up by the collapse of Carillion earlier this year are also concerning the wider support services industry. Delta Simons’ managing director, Alex Ferguson, asks: “What will happen to the sites Carillion signed up to manage the biodiversity for over the next 20 years? Well that is probably all gone now. If we are going to offset it needs to be done through the right funding mechanisms.”

However, the ramifications of the contractor’s demise do not worry Ramboll’s Matt Davies. “Despite Carillion, the projects will still be there and work needs to be done. As far as we are concerned we will always be needed – the way projects are funded will not change this,” he says.

“Large-scale infrastructure projects such as nuclear new build schemes are driving demand for the UK environmental sector" - Hisham Mahmoud, Golder Associates

Continuing on the subject of risk vs. reward when taking on various types of work, Golder Associates CEO Hisham Mahmoud says: “Large-scale infrastructure projects such as nuclear new build schemes are driving demand for the UK environmental sector. These large projects create both an opportunity and a risk to environmental and geotechnical consultancies with a potential overreliance on a few large scale projects. Something Golder manages through maintaining a balanced workload across a range of sectors both in the UK and internationally.”

That said, the recently rebranded Golder has preferred to stick to its guns in the space – focusing more on environmental support opportunities to mining and natural resource clients rather than going all out to win large-scale transport infrastructure schemes. And Dr Mahmoud is confident that the firm’s traditional work staples are now coming back on stream following a prolonged slowdown. He notes that Golder achieved growth in EC work for mining clients in 2017 and has also seen an increase in demand from UK and European-led oil & gas majors for environmental social impact assessment and reservoir modelling support in Africa and Central Asia.

“There is a noticeable increase in the number of mining opportunities over the past year,” continues Mahmoud. ”While commercial pressures with mining companies continue, projects are moving forward in response to increasing commodity prices and demand.”

Meanwhile, Arup’s Michael Bull doesn’t see the large infrastructure projects as a business risk – far from it: “This idea of falling off a cliff edge when a project ceases; we have found it’s more like a gentle slope once you take into account post-consenting work such as petitioning or construction monitoring. It has always been a manageable transition for us.”

But with major programmes of work such as HS2 and Heathrow expansion dominating UK EC market opportunities – generally playing to the strengths of the larger multidisciplinary operators – how are the smaller and medium-sized firms faring? Alex Ferguson, managing director of the 100-strong Lincoln-headquartered Delta-Simons says business is good. His firm has recorded double-digit growth for two years running, taking turnover in 2016/17 to £7.2m.

"With the big consultancies working on mega projects like HS2 there is a gap for the smaller consultancies to sweep up additional work", Alex Ferguson, Delta-Simons

"With the big consultancies working on mega projects like HS2 there is a gap for the smaller consultancies to sweep up additional work,” says Ferguson. “Due to conflicts of interests we have also found they are not bidding for work, for instance, with local developers which we would say are our regular clients.”

"With the big consultancies working on mega projects like HS2 there is a gap for the smaller consultancies to sweep up additional work,” says Ferguson. “Due to conflicts of interests we have also found they are not bidding for work, for instance, with local developers which we would say are our regular clients.”

Delta-Simons has developed its business largely on the back of contaminated land services for the commercial development and property sectors, and is proud of its involvement in the Stratford Olympic Village (pictured below). A growing demand for distribution and logistics centres has recently seen the firm providing phase one and phase two remediation assessments, alongside permitting and ecology services, for speculative developers.

“One of the reasons growth is so strong is the logistics sector is flying,” says Ferguson. “We have seen a lot of investment – because of the growth in e-commerce. For every time the high street suffers – warehouse stock distribution centres gain.”

Policy landscape

Whether it is a result of Brexit-bandwidth issues caused by an understaffed civil service, or simply a lack of political appetite for change right now, there is very little to get excited about in terms of environmental legislation coming forward.

Ramboll’s Davies certainly doesn’t mince his words when asked about environmental policy as a driving force for his EC team going forward. “I can’t see any strong policy drivers coming forward now. But fortunately the government’s continued focus on prioritising housing and infrastructure is keeping us busy,” he says.

The eagerly anticipated 25-year environment plan, published at the start of the year, is conceptually ambitious but ultimately toothless – with a plethora of upcoming reports and white papers needed to flesh out the details. However, the report was notable for the government’s continued support for natural capital and ‘no net loss’ of biodiversity – possibly because some of its flagship schemes such as HS2 rely on the mitigating principles which underpin them, particularly biodiversity offsetting. But this is good news for a consultancy like RSK, which is actively exploiting this opportunity with the establishment of a new habitat management contracting business (EA 27-Feb-18).

However, there are some changes that could alter the landscape more significantly. At the start of April, the Minimum Energy Efficiency Standards (MEES) entered into force requiring commercial property lettings to have an energy performance certificate rating of E or lower. With around 20% of non-domestic property failing to meet this requirement, it is reasonable to expect energy efficiency services to spike in 2018.

"After Brexit it will be politically difficult to cut environmental legislation, but it will be much easier to be selective with its enforcement" - Michael Bull, Arup

In the summer there will also be a review of the National Planning Policy Framework with last year’s Housing White Paper indicating that increased house building will remain a priority. The draft publication of the NPPF released recently points to stricter measures on local-plan making, reduced local “bureaucracy” and a renewed emphasis on brownfield development. But there has been criticism from housebuilders it doesn’t go far enough. Ongoing pressure to do more in tackling air pollution and the likely fallout for aviation planning were also mentioned by our contributors to this feature. But generally these measures are not considered in any way game-changers for the sector, but rather simply interesting tweaks.

The potential for future upheavals in environmental policy from Brexit remains an area of intense interest for consultants – but no-one is really anticipating a regulatory bonfire as such. With the UK and the EU set to lock horns over trade, immigration and the economy, environmental policy is simply not going to be one of the major priorities for the government.

For the time being, how the UK replaces the Common Fisheries Policy and Common Agricultural Policy, and also how REACH law is managed alongside trade are probably the biggest areas of uncertainty. But for legislation like the Water Framework Directive or the Industrial Emissions Directive, pledges from Prime Minister Theresa May to simply transpose existing rules are encouraging. However, the one big concern surrounds enforcement.

The European Commission and European Court of Justice have been instrumental in ensuring the UK is held accountable to environmental targets set by Brussels over recent decades. Where breaches happen or targets slip – fines normally ensue. But when the UK leaves the EU, current rules mean the buck will stop at Parliament. While environment secretary Michael Gove has made some encouraging sounds on introducing a UK “environmental commission” of sorts – the absence of detail in the 25-year plan is a cause for concern.

“It's likely we will keep EU legislation, but our concern is the loss of the ‘stick’ of the EC and ECJ driving compliance,” says Arup’s Michael Bull. “After Brexit it will be politically difficult to cut environmental legislation, but it will be much easier to be selective with its enforcement.”

“There has been a lot of scaremongering on environmental policy,” says Royal HaskoningDHV’s Matthew Hunt. “Even the World Trade Organisation rules on the environment are onerous – so environmental protections will not get thrown out. Let’s not forget for every potential issue someone identifies a solution.”

But for those who think it is political suicide to pick a fight on environmental regulation, one need only look at the US to see how quickly things can change. With the arrival of Trump to the Whitehouse at the beginning of 2017 one of the most pro-environmental administrations was replaced by one of the most anti. Proof perhaps that stranger things have happened.

Closing the skills gap

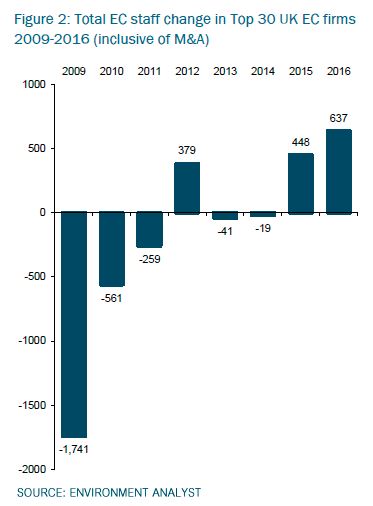

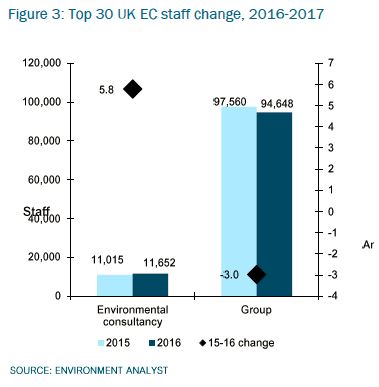

If there is one issue which is increasingly a cause for concern in terms of planning for growth and development of their businesses amonst our panel of commetators, it is the availability of skilled staff to service the extra work consultancies are winning year-on-year. During 2016 alone the top 30 UK EC players appointed in excess of 600 additional FTE employees taking their aggregate workforce to a total 11,650 – the highest it has been since the market’s pre-recession peak in 2008 (Figures 2 & 3). And Brexit is only seems to be serving to compound the problem, with Defra itself trying to add some 1,200 appropriately qualified individuals between 2017-2018 to help with the Brexit workload.

But the UK’s latest higher education student statistics show there were 95,000 students studying physical sciences in 2016/17. This includes chemistry, physics, earth sciences and geography among others. This would indicate that the talent pool is there, although not every graduate will move into environmental consultancy. But speaking to EA recently about tackling the skills gap, Arcadis’ managing director Andrew Limage said he believes “there are just not enough people coming through the university system in the UK with the necessary science/numerical-based qualifications”.

Whether those graduates are industry-ready is another issue entirely. And while many consultancies are taking on graduates, it is not the availability of entry-level staff which is the core issue for many firms. It is the project-ready veterans and those with commercial business development experience that are proving more difficult to come by. When the recession hit in 2008, redundancies were made en masse and people were forced into other professions so the industry saw the loss of a generation of experienced consultants. And now the sector is back up to its peak; competition for talent is fiercer than ever.

"It is difficult to attract talent because often you are trying to prise staff away from other consultancies – and if those other consultancies are doing well why would anyone move?" - Michael Bull, Arup

Arup’s Bull was refreshingly honest in his assessment of the recruitment challenges, stating: “It is difficult to attract talent because often you are trying to prise staff away from other consultancies – and if those other consultancies are doing well why would anyone move? We have had some success recruiting from firms which have been recently acquired and those attracted by Arup’s employee-ownership structure.”

There are four ways to get the skilled staff you need. Recruit, retrain, acquire and/or sub-contract. Most often firms employ a mix of approaches to fulfil their requirements, but not always successfully

“There is a skills shortage in certain areas of the environmental sector due to the positive impact on workload,” says Golder’s Dr Mahmoud. “Whether this demand is sustainable will depend on the government’s long-term commitment to develop public investment.”

Ramboll’s Matt Davies’ similarly points to the infrastructure pipeline as a bottleneck for recruitment: “If we do keep up with the levels of national infrastructure spend recruitment may become ever more challenging. Regardless their policy is creating demand – and we want to make sure we can maintain a very strong proposition in the marketplace – so we have to find staff.” Meanwhile, Matthew Hunt says Royal HaskoningDHV “grew our numbers last year, but we are still trying to get more staff. Noise and acoustics is an area we have always found challenging to recruit in – simply because it is quite a unique skill set”.

The free movement of people across the EU has been a real success story in the environmental consultancy space but this could be under threat from 2019 – depending on what deal the UK secures from the EU on immigration and European nationals working across the borders. Michael Bull points out that around one-quarter of Arup’s environmental consultants hold a passport from another country, with many Europeans amongst those; most have now taken steps to secure their future in the UK but employing EC citizens may prove to be more difficult in a year’s time.

Outlook

So skills shortages and a policy malaise might be acting as constricting factors, but presently both are being swept aside by a market inundated with infrastructure opportunities – but how long will the boom times last? Environment Analyst’s latest market assessment report projects 3.6% growth for the UK environmental consulting in 2018, down slightly compared to 2017 growth (estimated at 4.5%).

In 2019 growth is expected to be lower still given the political and economic upheavals of Brexit (Figure 4). Moreover, Environment Analyst’s annual industry Market Trends Survey undertaken between February and June last year found respondents’ five-year growth forecasts to be at their lowest in all the eight years we have conducted it. According to their unweighted forecasts, the compound annual growth rate projected for the market over the next five years fell from 4.6% in the 2016 survey to just 2.2% in 2017.

It’s a similar story for Arup. “Yes we are optimistic,” says Michael Bull. “As much as you never want to be over-optimistic we have a good order book of work – the big projects we have provide some confidence you will continue to have a base level of work.” A slightly more cautionary note is sounded by Matthew Hunt on behalf of Royal HaskoningDHV, who says: “We are cautiously optimistic at the moment. The market is fairly mobile and clients seem to be investing still in this market. The business environment is completely different to two years ago when the general election and Brexit referendum interrupted market progress.”

But it seems year is not the real concern; 2019 is. The UK was originally due to leave the EU at 11pm on Friday 29 March next year – but a two-year transitional period to smooth the path to exit is currently being negotiated in an attempt to provide assurance to business that a ‘cliff-edge’ scenario would be averted. But given the high levels of uncertainty, EA forecasts market growth of less than 1% in 2019 with growth accelerating again thereafter. However, any such transitional deal would likely significantly boost market prospects.

Copyright: Environment Analyst

View Environment Analyst version.

Related article: Managing Director talks to Property Week about work wellness